Daily Insights

Stay updated with the latest trends and news.

Ditch Your Premiums: Uncover Hidden Auto Insurance Discounts

Unlock secret auto insurance discounts and say goodbye to high premiums! Discover how to save big today!

Top 10 Hidden Auto Insurance Discounts You Might Be Missing

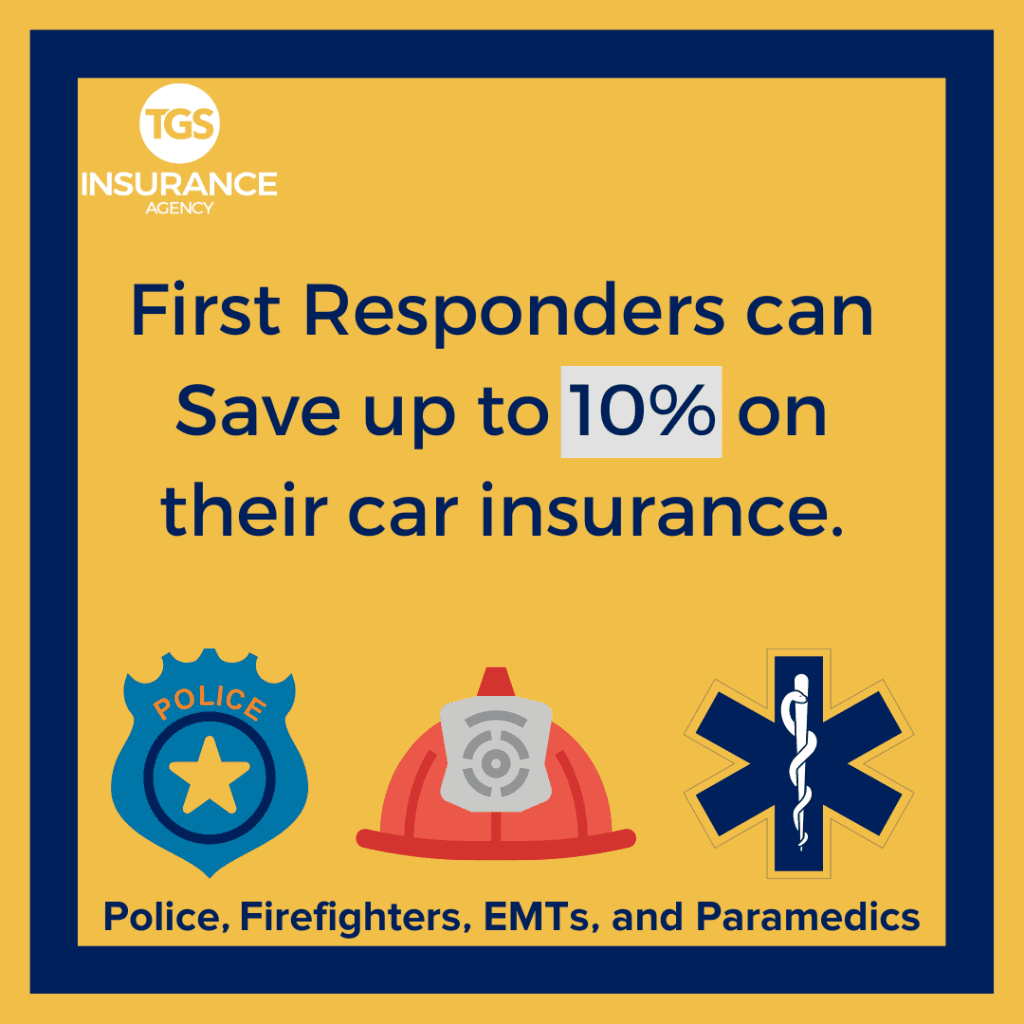

When it comes to auto insurance, many drivers are unaware that they may be eligible for a range of discounts that can significantly lower their premiums. These hidden auto insurance discounts are often overlooked, yet they can add up to substantial savings. For instance, discounts for safe driving records, bundling multiple policies, or having a vehicle equipped with advanced safety features are just a few examples. By taking the time to inquire about these potential savings, you could be missing out on more affordable car insurance rates.

Here are ten hidden auto insurance discounts you should definitely check if you qualify for:

- Good student discount for young drivers

- Low mileage discount for infrequent drivers

- Military discount for active service members

- Affinity discounts for members of organizations or associations

- Telematics discounts for using safe driving apps

- Renewal discount for loyal customers

- Early quote discounts for new customers

- Payment plan discounts for electronic funds transfer

- Homeownership discounts for homeowners

- Accident-free discounts for maintaining a clean driving record

By being proactive and asking about these auto insurance discounts, you can ensure you’re getting the best possible rate tailored to your unique circumstances.

How to Negotiate Lower Premiums: Insider Tips for Drivers

Negotiating lower premiums on your car insurance is a smart move that can save you a significant amount of money. One of the first steps is to review your current policy thoroughly. Look for any coverage options that you may not need, such as roadside assistance or rental car reimbursement. By eliminating unnecessary features, you can lower your overall premium. Additionally, it’s vital to compare quotes from multiple insurers. Shopping around can reveal different pricing structures that may work to your advantage, leading to better negotiation leverage.

Another effective strategy is to increase your deductibles. By agreeing to pay more out of pocket in the event of a claim, you can often lower your premium significantly. Furthermore, consider bundling your car insurance with other policies, like homeowners or renters insurance, which can lead to discounts. Don’t forget to ask about discounts! Insurers may offer reduced rates for safe driving records, good student status, or membership in certain organizations. Make sure to inquire about these possibilities to further negotiate a better deal.

Are You Overpaying for Auto Insurance? Discover These Common Discounts

Are you wondering if you're overpaying for auto insurance? Many drivers are unaware that they could be saving money on their premiums by taking advantage of common discounts offered by insurers. These discounts can vary widely between companies but can often lead to significant savings. For instance, most insurance providers offer multi-policy discounts, where you can save by bundling your auto insurance with other policies, such as home or renters insurance.

In addition to multi-policy opportunities, other prevalent discounts include safe driver discounts, which reward a clean driving record, and good student discounts aimed at younger drivers who maintain a high GPA. Furthermore, don't overlook low-mileage discounts if you rarely hit the road. To ensure that you are not overpaying for auto insurance, it's crucial to regularly review your policy and ask your insurer about any available discounts that may apply to your unique situation.