Daily Insights

Stay updated with the latest trends and news.

Trade Bots and Their CSGO Secrets: What You Didn't Know

Uncover the hidden secrets of trade bots in CSGO! Discover what you never knew about maximizing your trades and boosting your gameplay.

Demystifying Trade Bots: How They Impact CSGO Market Dynamics

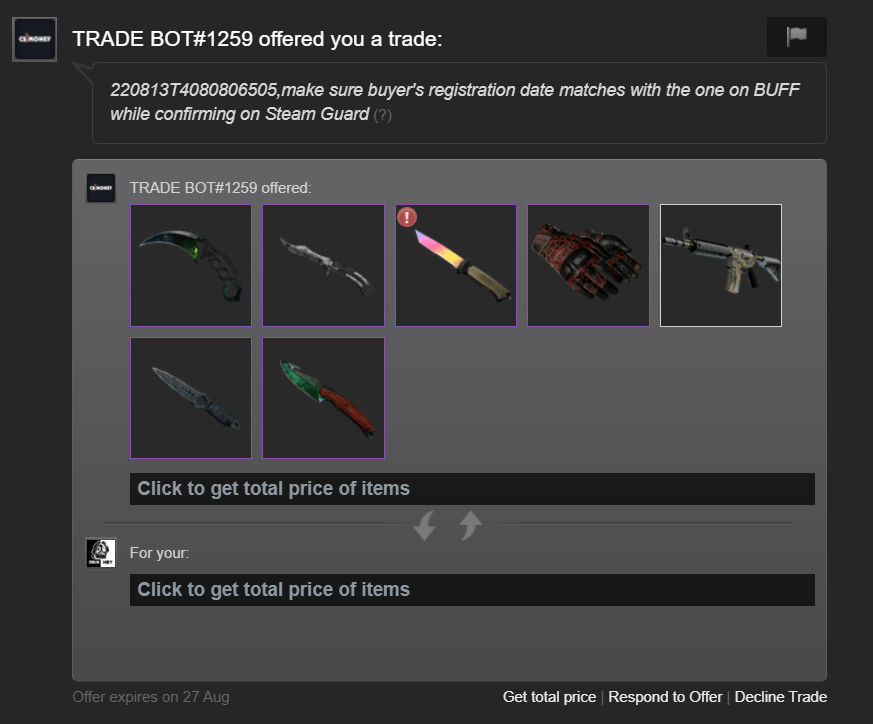

In the world of CSGO trading, trade bots have emerged as pivotal players, influencing market dynamics in ways that are often misunderstood. These automated systems, designed to facilitate the exchange of in-game items, operate by executing trades on behalf of users, thus minimizing the time and effort required for manual trading. The impact of trade bots is profound; not only do they streamline the trading process, but they also contribute to price stabilization by setting specific trade parameters. Understanding how these bots function can provide invaluable insight into the current trends and fluctuations in the CSGO market.

Moreover, trade bots have significantly altered the landscape of CSGO item trading by increasing accessibility for new traders and enhancing competition among seasoned players. By analyzing vast amounts of trading data and quickly adjusting to market demands, these bots can maintain a fluid environment where prices reflect real-time supply and demand. As a result, both casual players and serious investors must adapt their strategies to navigate this increasingly automated ecosystem. Embracing the capabilities of trade bots while recognizing their impact on market dynamics is essential for anyone looking to succeed in the CSGO trading arena.

Counter-Strike is a popular tactical first-person shooter game where teams compete to complete objectives or eliminate the opposing team. Players can enhance their gameplay experience by learning how to kick bots from their matches, allowing for a more competitive environment.

The Hidden Algorithms: What Makes CSGO Trade Bots Tick

The world of CSGO trade bots operates on a complex set of algorithms that dictate how these automated systems function in the bustling marketplace of virtual items. At the core of these algorithms lies a demand-supply mechanism that analyzes current market trends to evaluate item values. By utilizing machine learning, these bots can predict price fluctuations and adjust their trading strategies accordingly. This adaptability allows them to capitalize on opportunities, ensuring they remain competitive in a rapidly changing environment.

Moreover, the algorithms powering CSGO trade bots use sophisticated filtering techniques to ensure transactions are secure and beneficial. They often incorporate user reputation assessments, taking into account the feedback and trading history of users to mitigate the risk of fraud. These bots can also implement automated pricing strategies, where they dynamically alter the prices of items based on user behavior and engagement. Understanding these hidden algorithms is crucial for traders aiming to navigate the intricate world of CSGO item exchange effectively.

Are Trade Bots Cheating the System? Uncovering the Myths and Realities

The debate surrounding trade bots and their impact on financial markets is fueled by a mix of enthusiasm and skepticism. Critics argue that these automated systems can skew market dynamics, giving an unfair advantage to those with advanced algorithms and faster execution times. However, this perspective often overlooks the realities of how trade bots operate. Many of these bots use data-driven strategies that analyze market trends and execute trades based on pre-defined parameters. This leads to increased liquidity and can actually benefit the market by facilitating trades more efficiently. It's crucial to distinguish between cheating through exploitative practices and the legitimate use of technology to enhance trading performance.

Furthermore, the narrative that trade bots are cheating the system often stems from misconceptions about their functionality and purpose. For instance, not all bots are designed for high-frequency trading or to manipulate prices. In fact, many are utilized by retail investors to optimize their trading strategies or to automate mundane tasks. This automation allows investors to maintain a level of competitiveness without needing constant surveillance of the markets. In light of these factors, it becomes evident that while there are instances of unethical use, the majority of trade bot applications are not about cheating but rather about leveraging technology to enhance the trading process. Understanding these distinctions is key to forming a balanced view of the role of trade bots in today's financial ecosystem.